Janet Wilhelm

Business Day - 28 February 2022 by Neva Makgetla (TIPS Senior Economist)

The major new projects planned for South Africa – including a gold mine and a massive data centre

BusinessTech - 11 March 2022

The Real Economy Bulletin - Fourth Quarter 2021

Main Bulletin: The Real Economy Bulletin - Fourth Quarter 2021

In this edition

GDP growth: The GDP expanded by 1.2% in the fourth quarter of 2021, bringing growth for 2021 as a whole to 4.9%, despite the 1.7% contraction in the third quarter and the COVID-19 surge in December. Read more.

Employment: Statistics South Africa has delayed publication of the Quarterly Labour Force Survey (QLFS) for the fourth quarter of 2021 indefinitely because of a low response rate. The alternative source of information on formal employment, the Quarterly Employment Survey (QES), has since reported a 0.5% increase for the third quarter of 2021. The QES provides far less information than the QLFS on employment by industry, region, race and gender, so the resurrection of the QLFS, based on in-person interviews, is crucial for economic decision-making and monitoring in the future. Read more.

International trade: The surplus on the balance of trade for goods continued to drift downward as commodity prices flattened out and the cost of petroleum climbed in the fourth quarter of 2021. The impact of the Russian invasion on commodity prices may disrupt these trends in 2022. Read more.

Investment: Private investment climbed 4.2% in the fourth quarter of 2021, although it remained 9% below pre-pandemic levels. Public investment declined, ending the year 10% lower than before the pandemic. Read more.

Foreign direct investment projects: The TIPS Foreign Direct Investment Tracker monitors FDI projects on a quarterly basis, using published investment information. It identified 24 new projects in the fourth quarter of 2021. The 24 projects reported entailed a total investment value of approximately R126 billion. The bulk came from a single manufacturing project, a US$4.6 billion (R70.5 billion) green ammonia export plant. Most of the other projects fall under the fifth window of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). Read more.

Briefing Note: The Ukraine war and the South African economy: The war in the Ukraine has vastly increased uncertainty for the global economy, and consequently for South Africa. The war itself will have limited impact on trade because South Africa has only very limited economic ties to Russia and Ukraine. But it has already led to extreme volatility in commodity prices, affecting both export products and as well as petroleum, wheat and fertiliser imports. It seems likely to disrupt international capital markets as well. In the longer run, it may prove a significant drag on growth in the global North, which is still South Africa’s main export market. Read the Briefing Note online: The Ukraine war and the South African economy.

Briefing Note: Towards an inclusive rollout of electric vehicles in South Africa: mobility is high. The world is rapidly moving towards e-mobility. Pushed by environmental regulations, support programmes and improving economics, electric vehicles (EVs) that is traditional hybrid (HEV), plug-in hybrid (PHEV) and battery electric (BEV) vehicles, are set to become dominant in the coming decades. Yet this electric revolution risks leaving many commuters behind, further deepening inequalities between and within countries. The risk of an exclusionary, elitist transition to e-mobility is high. Read the Briefing Note online: Towards an inclusive rollout of electric vehicles in South Africa.

Electric vehicles (EVs) increasingly feature on the roads of the world. Pushed by environmental regulations, support programmes and improving economics, they are set to become dominant in the coming decades. Yet, the rollout of EVs risks leaving many behind. This policy brief considers the rollout of EVs in South Africa, focusing on the

opportunity to foster an inclusive transition to e-mobility for passenger transport. Given the structure of the South African economy, a dual strategy is required. The brief first looks at how an inclusive rollout of passenger cars could be incentivised in South Africa, effectively to sway entry-level buyers (i.e. upper middle-income households) to purchase EVs instead of internal combustion engine (ICE) vehicles. It then considers how to introduce EVs into public transport, to extend the benefits of e-mobility to low-income and lower middle-income households in the country.

Research undertaken in 2021 generated an evidence base of just transition project characteristics and financing needs in South Africa. The Mpumalanga sample of 26 projects covered a range of economic diversification interventions. Projects with novel technology opportunities related to land, water rehabilitation and agricultural dominated the sample. All the projects were designed specifically to provide alternative employment and livelihood opportunities for workers and communities negatively affected by climate change and decarbonisation activities. The research showed that decarbonisation projects and associated investments were predominantly technology driven and sought as their core outcome reduced carbon emissions. Just transition projects and associated investments were people driven and sought as their core outcome improved socio-economic circumstances such as increased employment, new livelihood opportunities, skills development, improved access to services, and increased community asset ownership. Adaptation investments were more closely aligned to just transition outcomes than decarbonisation outcomes. Based on this research, it is argued that while the funding for decarbonisation and just transition investments are fundamentally interrelated, intertwined (and usually negotiated as a single package of funding),decarbonisation transactions and just transition transactions will chase different outcome measures resulting in different risk return profiles and different instruments anddeployment channels. It is therefore necessary to understand just transition finance supply and demand as a separate use of funds.

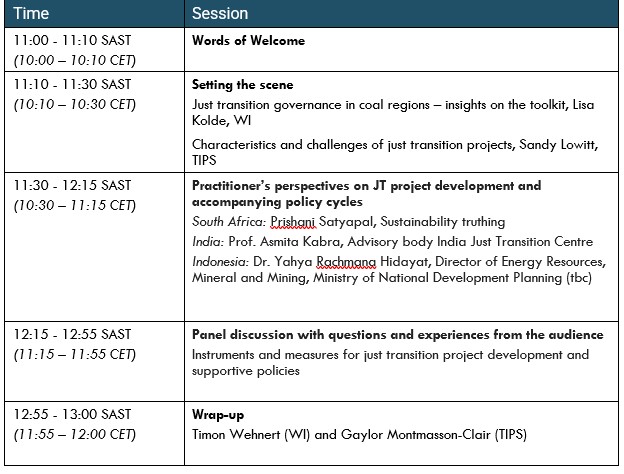

Just Transition in action: Rethinking traditional project development and support tool kits and policies

Press release: Unpacking the Just Transition in practice

Article:TIPS says broader, engaged development approaches needed to realise just transition projects (Marleny Arnoldi, Engineering News 25 March 2022)

Background

Development institutions tend to work according to an established framework, which helps practitioners and funders structure and plan their actions. This traditional model is based on empirical observations and on the ground experience of how project development and support policy work in practice. Key steps include:

- defining the problem and agenda setting;

- defining the vision and objectives of the strategy;

- identifying and selecting options, and implementing actions;

- monitoring, reporting, evaluation and policy adaptation.

The above cycle describes an idealised process, which differs from "real-life" processes. Steps are sometimes taken in parallel, and within one cycle not all steps may be covered completely. Recent examination of just transition projects and project development cycles suggest that the characteristics of such projects and their development may require an expanded or amended toolbox of actions, funding and sequencing.

For example, just transition projects require expanded participatory processes. Activities to support meaningful participation may thus need to be undertaken and funded to ensure participating workers or communities are able to engage both at a substantive as well as a process level. Another example is that environmental and green solutions sought by just transition project developers may require the inclusion of an expanded view of beneficiaries, given that environmental systems (such as water sheds) do not adhere to political or community boundaries. A final example is that just transition project developers will most likely require a range of funders to become involved in the project development cycle earlier than in traditional project finance. This idea of financial sector players making deals as opposed to buying deals will require additions to the existing project development and policy support toolbox.

The webinar investigates how different countries deal with these emerging issues. In particular, the following questions will be addressed: Does participatory planning call for different policy instruments and mechanisms as well as a different policy cycle? Do just transition projects require different financial support mechanisms and instruments at different times to traditional projects? How is the scope of just transition projects (especially those seeking to address environmental degradation) different from traditional projects and what instruments, mechanisms and policy support measures can be developed.

Outline of the event

Date: 24 March

Organisations: Trade & Industrial Policy Strategies (TIPS) and Wuppertal Institute für Climate, Environment and Energy (WI)

Enquiries: rozale@tips.org.za

The potential for biomass supply chains to provide alternative employment opportunities for people currently employed in coal trucking is vast. Side tipper trucker jobs are a low-hanging fruit as they are used both for the transportation of coal and the largest source of sustainable biomass in South Africa, namely invasive alien plants. Almost 75% of the current coal jobs could be directly transitioned to biomass transport via side tipper trucks. In addition, the biomass supply chains considered in this study could supply over 600 superlink driver jobs. About 480 superlink trucks would be required, which means some of the current coal side tipper trailers would have to be converted to flatbeds. More than 300 tanker driver jobs could furthermore be provided by the biomass supply chain.

This report is part of the Making Sense of Employment in South Africa's Just Energy Transition project. TIPS and the WWF South Africa, with the support of GIZ, are implementing an initiative to support policymaking for South Africa's just transition. This focuses on employment and the relevant challenges and opportunities in the country's just energy transition.

Download full report or read online

Exploring alternative options for coal truckers in a biomass supply chain - Highlights

The energy shift will result in a reduction in coal use, and thus a reduction in coal transportation, which currently provides employment for approximately 4000 truck drivers. Given South Africa's large biomass feedstock base and parallels in coal and biomass hauling operations, coal transporters may be able to find alternate livelihoods by hauling sustainable biomass for emerging green industries such as manufacturing sustainable aviation fuels (SAF). Establishing nationwide biomass supply chains could result in nearly 7 500 trucking jobs, over half of that (about 3 800) in coal producing regions, providing coal haulers an alternative option.

Almost 3 000 trucker jobs in the coal regions could be for side tipper truck drivers, meaning that almost 75% of the current coal hauling jobs could be directly transitioned to biomass hauling. In addition to the jobs saved in refueling and truck maintenance, biomass supply chains in coal districts could result in the creation of approximately 400 support jobs.

More details can be found in the infographic below, and the full report.

Dowload or view infographic online

.

Import Tracker - Q3 2021

South Africa continued to maintain a strong trade balance in the third quarter of 2021, with a surplus of R102 billion, down 11% from the third quarter of 2020. High mineral prices continue to be the main driver for the high surplus, although these prices are beginning to fall. In addition, exports to major trade partners such as the United States, Japan and the United Kingdom improved in the year to the third quarter of 2021, rising by 20%, 90% and 52% respectively. Exports reached the highest third quarter level in 2021 at R460 billion, from a previous high of R406 billion in the third quarter of 2020.

TIPS FORUM 2022 CALL FOR PAPERS

The Forum seeks to facilitate knowledge sharing and deepen the understanding of the dynamics of moving towards a Just Transition. It will consider how industrial policy can support and drive structural transformation towards a Just Transition, so that South Africa’s move to a low-carbon economy is inclusive and equitable, and ensures social protection for affected communities and workers.

The Forum offers an opportunity for discussion on the various dimensions of green industrialisation and green industrial policy in the South African context. In doing so, the Forum intends to encourage discussion that considers the challenges and opportunities of pursuing a Just Transition, as well as providing an opportunity to share case studies and international best practices. Lastly, the Forum will provide an opportunity for presenters to highlight the various existing initiatives in South Africa, in the broader context of regional and global value chains.

Calls to diversify and divest from a dependence on coal are growing, and South Africa is under pressure to reduce emissions and accelerate its transition to a low-carbon economy, to meet its goals of the Paris Agreement. It is important to put in place appropriate policies to drive the transition. The Presidential Climate Commission was established in 2020 to enable policies to support South Africa’s Just Transition. Many of South Africa’s key trading partners support the adoption of low-carbon policies and intend to reduce emissions and impose trade restrictions on carbon-intensive goods. Without fundamental moves toward green manufacturing, South Africa risks losing its global competitiveness and export markets. Efforts by government are important, as they provide a signal to the private sector to encourage investment in building resilient energy systems, sustainable agriculture, green industrialisation, and in reshaping value chains.

The 2022 Forum will discuss these issues and bring together academics, policymakers, civil society organisations, workers and practitioners.

TIPS is partnering with, and receiving financial support for the Forum from, the DSI/NRF South African Research Chair in Industrial Development (SARChI) based at the University of Johannesburg and the UK Partnering for Accelerated Climate Transitions (UK PACT). The Forum will be undertaken in association with the Department of Trade Industry and Competition (the dtic).

Call for Papers

Authors are invited to submit an abstract of up to 500 words. To be considered, abstracts should be submitted by Monday 16 May 2022. Authors will be notified of the decision by Friday 27 May 2022. Final papers are due for submission by Friday 22 July 2022. Abstract submissions should include full contact details of the authors.

If you wish to contribute, please submit the title of your paper and the abstract to Daphney Mabuza at TIPS via email to: daphney@tips.org.za

Themes

The TIPS Forum aims to deepen the understanding of the intersection between Just Transition trajectories and industrial policy. This includes looking at the actions required from industrial policy to support green industries and the development of new technologies and sectors, and to ensure equitable distribution of the costs and benefits.

Submissions are invited on broad themes including:

- Promoting green and inclusive industrial development.

- Supporting economic diversification of coal regions.

- Implementing a Just Transition in various economic value chains, such as electricity, liquid fuels, heavy industry, transport, and agriculture.

- Financing a Just Transition.

- Enacting participatory, distributive and restorative justice at global, national and local levels.

- Monitoring and measuring progress towards a Just Transition.

- Environmental restoration and economic development.

- Fostering inclusive business models.

- Economic development and ownership issues.

- Just Transition, resilience and climate change adaptation.

- Economic inclusion and the Just Transition.

- Labour market dynamics and the Just Transition.

- Gender and the Just Transition.

- Technological change and its impact on a Just Transition.

- Public employment and universal basic income issues.

The 2022 TIPS Forum will be held in a hybrid format allowing for both in-person and virtual participation. Please note that we will require that all in-person attendees wear masks throughout the event and provide proof of vaccination.